Through invoice factoring, a business can use its invoices to borrow the amount its customers can pay in the future: The lender receives the Bill and its upcoming payment, although the business receives quick-term funding.

Some incubators will cost decreased service fees, while some ask for payment at the end of your deal, once your business has a chance to increase.

Necessities fluctuate by lender, but businesses usually qualify for business loans depending on size, income, particular and company credit profiles, and how long they’ve been running. They get financing as lump sums or credit score traces, according to the type of loan and lender.

Discover funding for your up coming auto or refinance with self-confidence. Take a look at right now’s car loan charges.

Lenders offer you several different loans for businesses based upon what The cash is going to be useful for And exactly how firms are ready to guarantee payment.

Secured loans require collateral to back again up the amount of the loan, which means you can eliminate Whatever you set up in the event you are unsuccessful to pay for in complete.

Starting up your individual business is interesting, but in addition stuffed with challenges. To be able to start your business, you require the best quantity of funding.

Standing. Beyond only borrowing from highly regarded establishments, it’s essential to discover a lender which has a great customer support track record. If there’s ever a concern with the loan, speaking to a handy purchaser aid team could make the situation significantly less complicated.

It’s most effective if you’re an established business with certain, time-sensitive wants, due to the fact eligibility is tougher and new businesses might not be accredited. The loan amounts cap out at $350,000, but as a consequence of their pace they’re excellent in case you’re eligible and need considerably less money for an urgent or market require.

Seize chances after they present them selves. We clarify what a federal government-certain SBA loan is and help you discover choices to suit your small business loan wants.

Unsecured loans are granted to businesses with good credit score ratings and will offer decrease curiosity fees than secured loans.

Not all loan time period lengths are offered to all prospects. Eligibility is based on creditworthiness and also other variables. Not all industries are suitable for American Categorical® Business Line of Credit history. Pricing and line of credit history decisions are according to the overall financial profile of both you and your business, together with background with American Express as well as other monetary establishments, credit rating historical past, and various things. Traces of credit score are matter to periodic assessment and may alter SBA 504 business loan Nevada or be suspended, accompanied with or with out an account closure. Late service fees and return payment service fees could possibly be assessed. Loans are issued by American Express Nationwide Bank. ¹ Minimum FICO rating of at the very least 660 at the time of software. All businesses are unique and they are matter to acceptance and evaluate. The necessary FICO rating could possibly be greater dependant on your connection with American Express, credit rating record, and various aspects.

With QuickBridge, you could choose the way you’d love to allocate the cash from the small business loan. We don’t just deliver funding. We offer lending solutions which make for an improved, smarter small business loan.

Our editorial group gets no direct payment from advertisers, and our content material is comprehensively truth-checked to be certain precision. So, no matter if you’re looking through an article or an evaluation, you'll be able to trust that you choose to’re acquiring credible and trustworthy info.

Freddie Prinze Jr. Then & Now!

Freddie Prinze Jr. Then & Now! Brooke Shields Then & Now!

Brooke Shields Then & Now! Bill Cosby Then & Now!

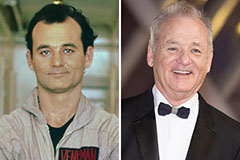

Bill Cosby Then & Now! Bill Murray Then & Now!

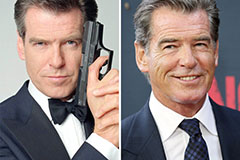

Bill Murray Then & Now! Pierce Brosnan Then & Now!

Pierce Brosnan Then & Now!